Income Tax By State Map

Income Tax By State Map

Income Tax By State Map - Zoom between states and the national map to see the most tax-friendly places in each area of the country. 03062020 State income tax map. The states are prohibited from taxing income from federal bonds or other obligations.

The 9 Places In The Us Where Americans Don T Pay State Income Taxes Markets Insider

27012021 no state income tax Most Americans file a state income tax return and a federal income tax return.

Income Tax By State Map. The National Finance Centers NFC Interactive Tax Map makes researching tax formulas easy by allowing you to select your state instead of browsing through a list of bulletins. Income and Payroll Taxes. Compared by average income tax bracket.

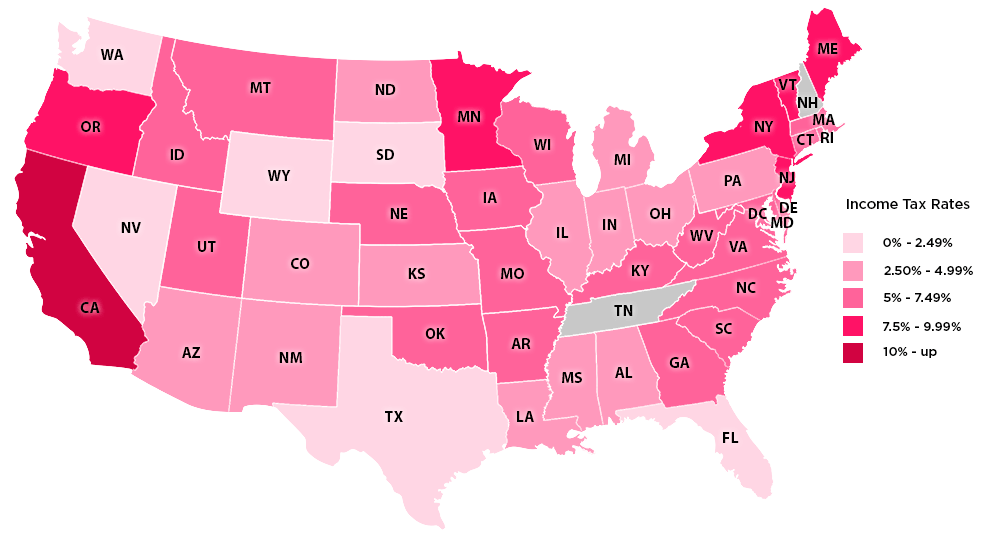

Scroll down for a list of income tax rates by state. The rates vary by state. Click here for the embed code.

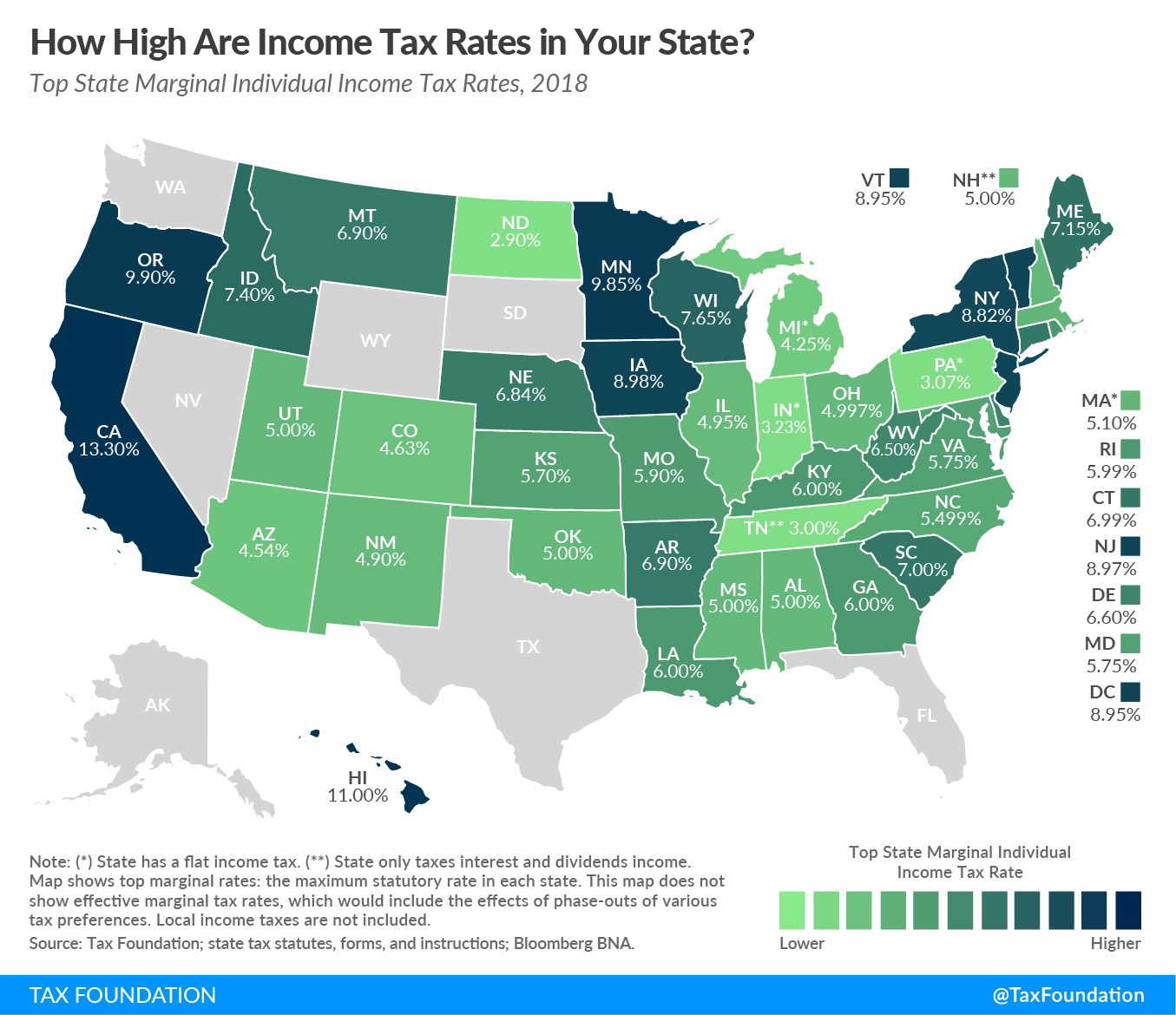

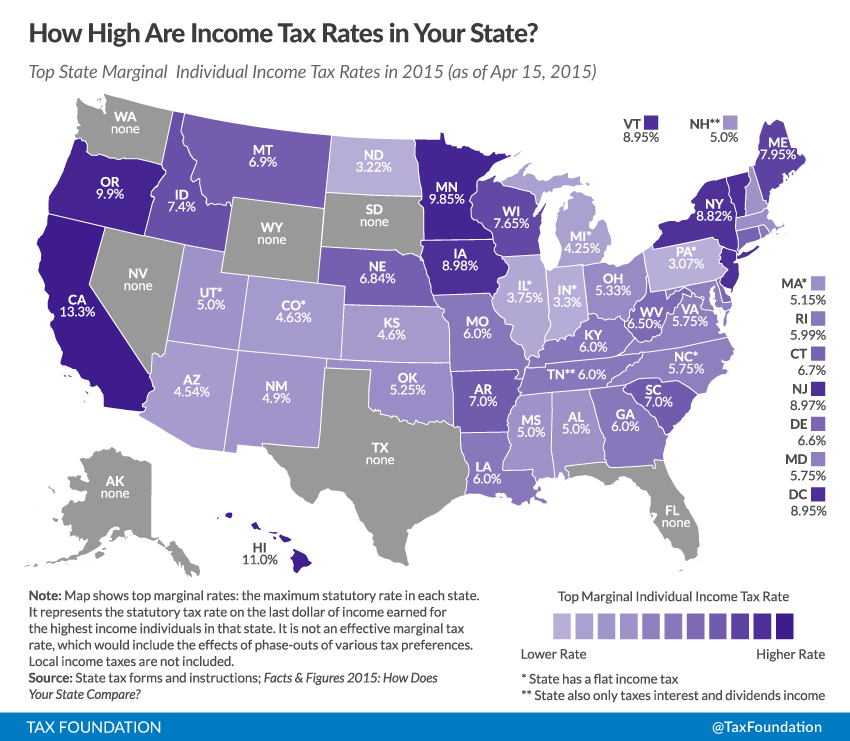

Methodology To find the most tax friendly places for retirees our study analyzed how the tax policies of each city would impact a theoretical retiree with an annual. Individual and Consumption Taxes. Top State Income Tax Rates Read the report that this map came from here.

Individual and Consumption Taxes. Estate and Gift Taxes. If you are not registered with the e-filing portal use the.

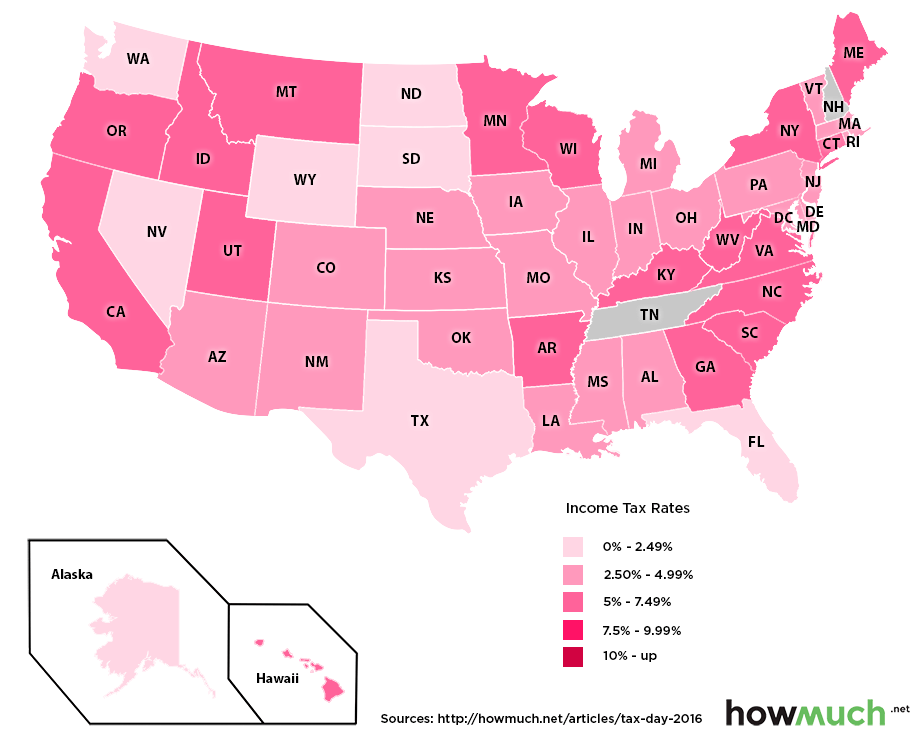

And check out the second map to determine which states use a flat rate or progressive structure for state income taxes. Individual income taxes blue payroll taxesFICA green corporate income taxes red. Would your readers enjoy this interactive map of the states with the lowest property taxes.

Explore our weekly state tax maps to see how your state ranks on tax rates collections and more. Federal taxation and. Based on the lowest average or highest tax brackets.

Percentage of Home Value Median Property Tax in Dollars. You may be one of them. Each state has its own income tax rules and rates.

Income Taxes Sales Taxes Property Taxes Corporate Taxes Excise Taxes. Tax Expenditures Credits and Deductions. Income and Payroll Taxes.

Also check out the tax-specific slideshows listed below the map. State-by-State Guide to Taxes on Retirees Click on any state in the map below for a detailed summary of state taxes on retirement income real property every-day purchases and more. States with maximum state income tax rates of at least 6 but less than 7 include Connecticut Arkansas Montana Nebraska Delaware West Virginia Georgia Missouri Kentucky and Louisiana.

Interested in the most recent up-to-date income tax formula for your area. Excise and Consumption Taxes. Check the income tax regulations for your state.

Most do not tax Social. Click on any state in the map below for a detailed summary of state taxes on income property and items you buy on a daily basis. State income tax is imposed at a fixed or graduated rate on taxable income of individuals corporations and certain estates and trusts.

Another nine have a flat tax rateeveryone pays the same percentage regardless of how much they earn. Compare relative tax rates across the US. If you find the information on this page useful please consider making a donation to support the work of the Tax Foundation.

01122020 The state income tax rate can and will play a role in how much tax you will pay on your income. Each formula also provides a link back to the previous formula so you can compare any changes that may have taken place. In 2013 Income Tax Department issued letters to 1219832 non-filers who had done high value transactions.

Capital Gains and Dividends Taxes. Using data from the National Association of Home Builders we compiled an interactive map to compare property tax rates by state. 4000 4000-6000 6000-8000 8000-10000 10000-12000 12000-14000 14000-16000 16000-18000 18000 Share of federal revenue from different tax sources.

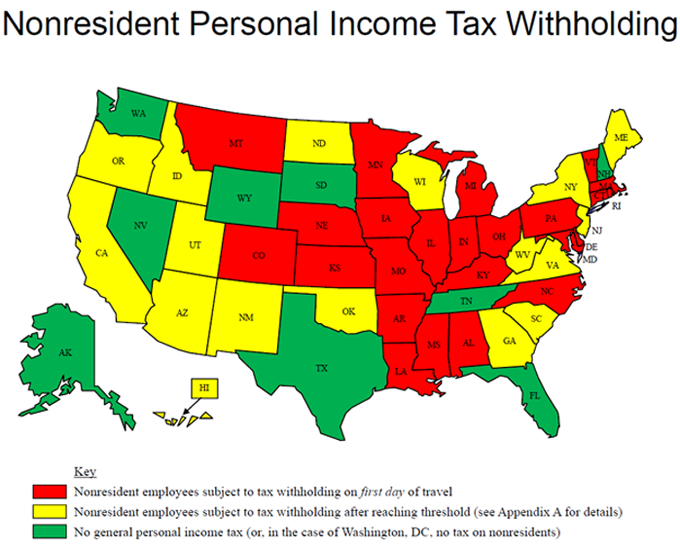

Federal Income Tax - Minimum Bracket 10 Maximum. Reciprocal agreements Theres another. The state has no state sales tax but does levy excise taxes including taxes on alcohol and its average property tax rate of 220 is the third-highest in the country.

Capital Gains and Dividends Taxes. Taxable income conforms closely to federal taxable income in most states with limited modifications. The map is interactive and you can hover over any US state to see the rate or range of income tax that each of the states imposes.

As of 2021 the states with no income tax are Alaska Florida Nevada New Hampshire South. Hover over any state for tax rates and click for more detailed information. In 2014 Income Tax Department has identified additional 2209464 non-filers who have done high value transactions.

California Hawaii Oregon Minnesota and New Jersey have some of the highest state income tax rates in the country and seven states have no tax on earned income at all. Use the map below for a visual of which states have income tax on employment income. Map of average federal tax revenue per capita by state in 2007.

Sales taxes in the United States are administered on a state level in all but the five states with no state sales tax as well as locally by counties and cities in the 37 states that allow municipal governments to collect their own local option sales taxesThis means that sales taxes can be quite complicated and a simple map of state sales tax rates doesnt cut it as a method of visualizing. A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes. The following map shows a list of states by income tax rate.

Log on to e-filing portal at httpsincometaxindiaefilinggovin. Rank City Income Tax Paid Property Tax Rate Sales Tax Paid Fuel Tax Paid Social Security Taxed. Tax Compliance and Complexity.

Lowest Tax Highest Tax Compare by. 16112020 Property Taxes by State Interactive Map The average property tax rate varies greatly from state to state. Overall state tax rates range from 0 to more than 13 as of 2020.

/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png) States With Minimal Or No Sales Taxes

States With Minimal Or No Sales Taxes

The States Where You Pay The Most And Least Tax Mapped Digg

States With The Lowest Corporate Income Tax Rates Infographic

States With The Lowest Corporate Income Tax Rates Infographic

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

State Individual Income Tax Rates And Brackets For 2018 Tax Foundation

State Individual Income Tax Rates And Brackets For 2018 Tax Foundation

Which U S States Have The Lowest Income Taxes

Which U S States Have The Lowest Income Taxes

Compare Sales Income And Property Taxes By State Us Map 2011 My Money Blog

Compare Sales Income And Property Taxes By State Us Map 2011 My Money Blog

File Map Of Usa Highlighting States With No Income Tax On Wages Svg Wikipedia

File Map Of Usa Highlighting States With No Income Tax On Wages Svg Wikipedia

Road Warrior State Income Tax Laws Vary Widely The Pew Charitable Trusts

Road Warrior State Income Tax Laws Vary Widely The Pew Charitable Trusts

Infographic Tax Day Income Tax State Tax Budgeting Money

Infographic Tax Day Income Tax State Tax Budgeting Money

State By State Guide To Taxes On Middle Class Families

State By State Guide To Taxes On Middle Class Families

What Is State Income Tax Charts Maps Beyond

What Is State Income Tax Charts Maps Beyond

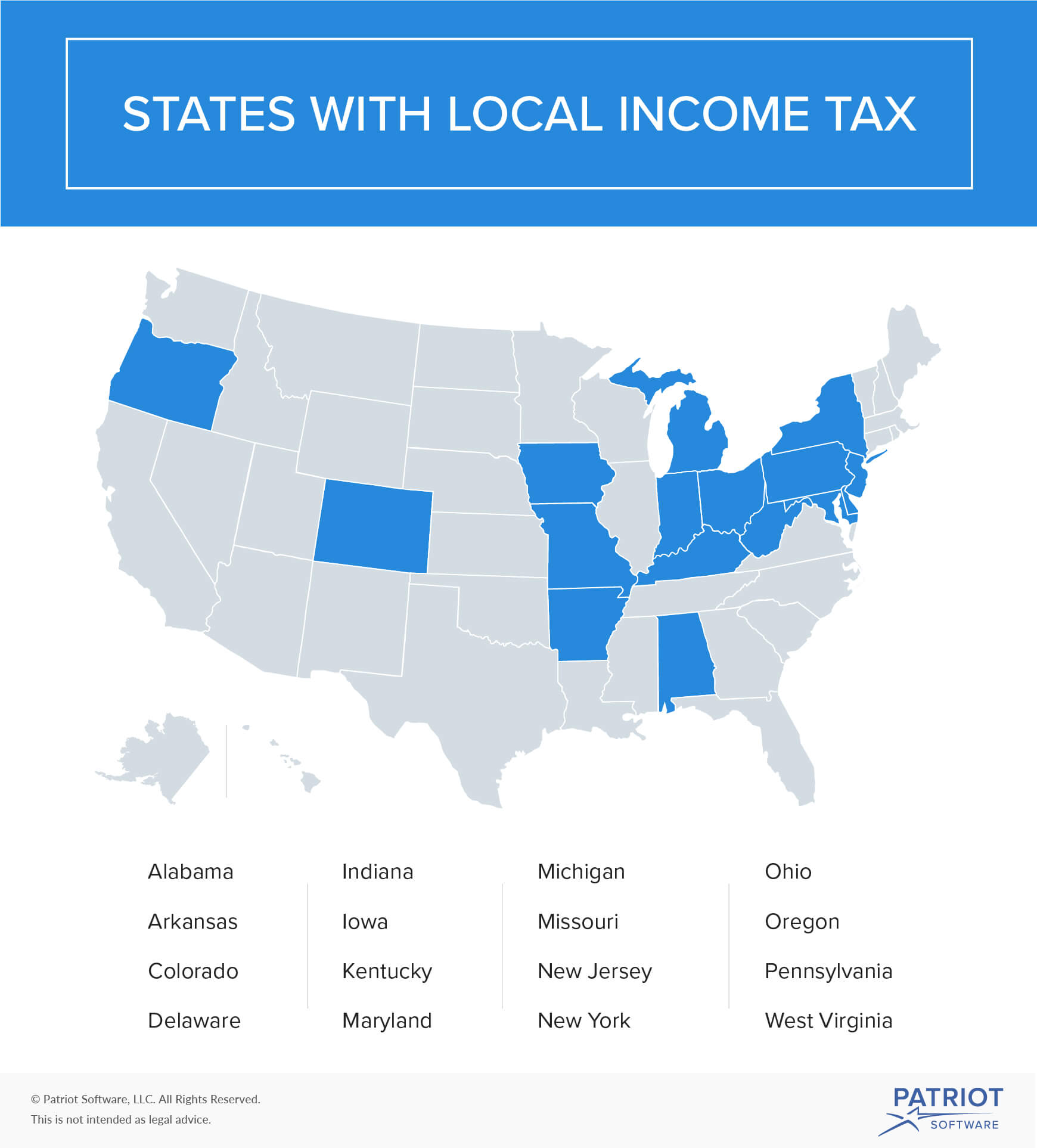

What Is Local Income Tax Types States With Local Income Tax More

What Is Local Income Tax Types States With Local Income Tax More

State By State Guide To Taxes On Retirees

State By State Guide To Taxes On Retirees

Pin On Global Issues Economics

Pin On Global Issues Economics

Npr States With No Personal Income Tax

7 States Without An Income Tax And An 8th State On The Way Income Tax Tax Rate Tax Free States

7 States Without An Income Tax And An 8th State On The Way Income Tax Tax Rate Tax Free States

One Telecommuting Employee Can Subject A Business To Corporate Income Tax In More States Cpa Practice Advisor

One Telecommuting Employee Can Subject A Business To Corporate Income Tax In More States Cpa Practice Advisor

Let S Map Our Income Tax Rates Completely Opposite To The Legend Dataisugly

Let S Map Our Income Tax Rates Completely Opposite To The Legend Dataisugly

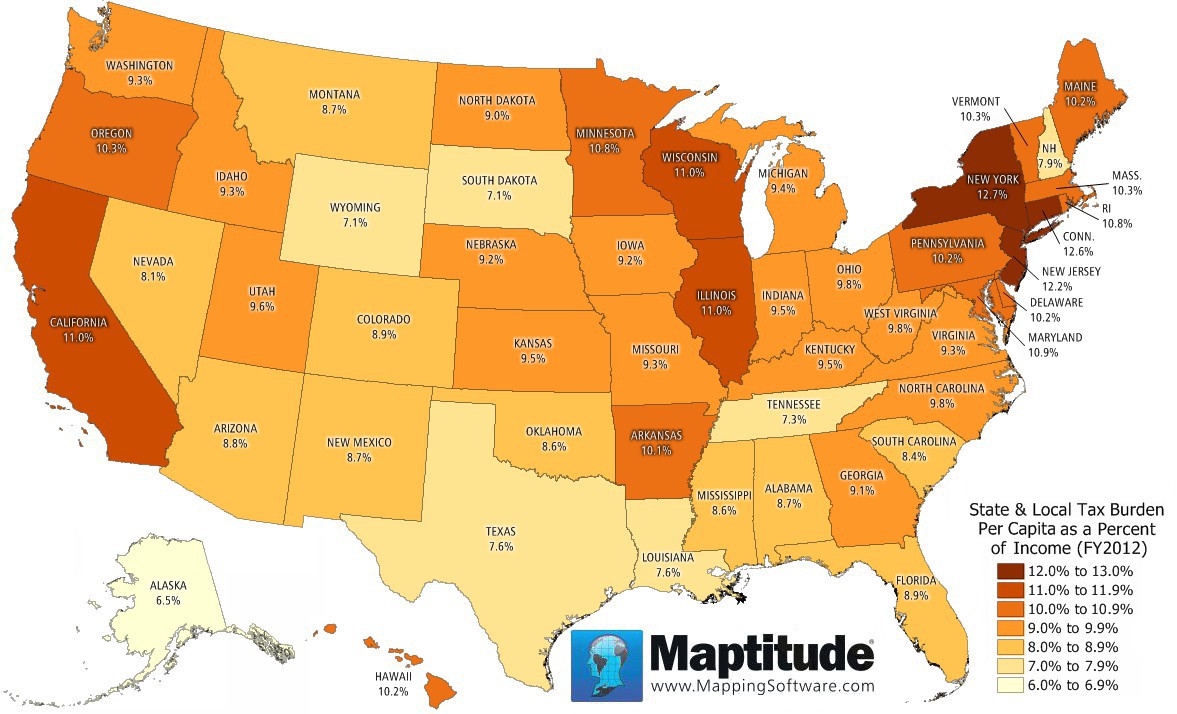

Maptitude Map State Income Tax Burden

Maptitude Map State Income Tax Burden

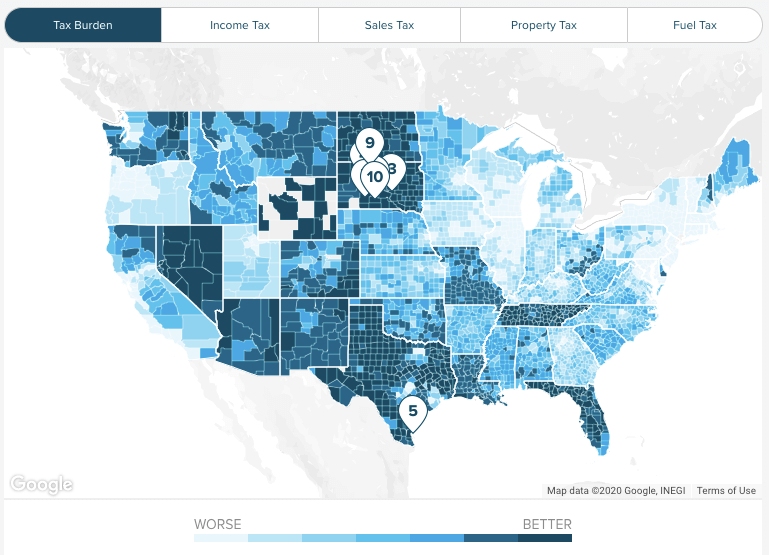

Free Income Tax Calculator Estimate Your Taxes Smartasset

Free Income Tax Calculator Estimate Your Taxes Smartasset

How High Are Income Tax Rates In Your State Tax Foundation

How High Are Income Tax Rates In Your State Tax Foundation

Which U S States Have The Lowest Income Taxes

Which U S States Have The Lowest Income Taxes

Post a Comment for "Income Tax By State Map"